Our off-the-shelf bond structures provide clients with a rapid and cost-efficient route to market.

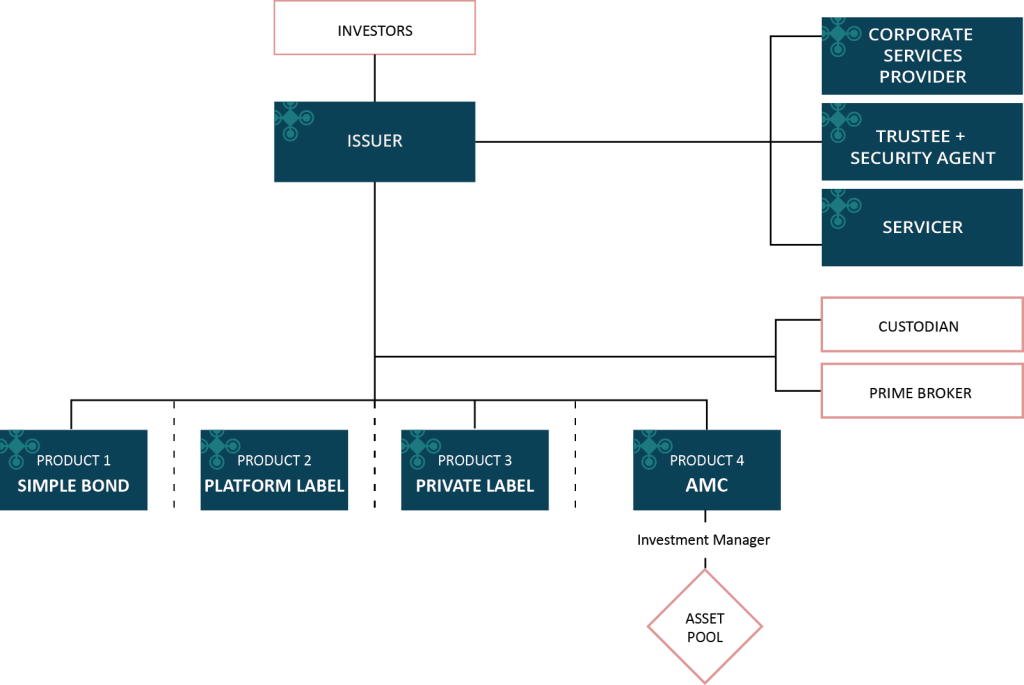

Our London based, in-house legal, trustee and servicing teams provide an end-to-end service covering all aspects of the transaction, saving you time, money and the effort of coordinating multiple advisers.

Our bonds provide numerous advantages in debt capital raising.

Our structures provide capital income, capital growth or a combination.

Bonds open-up secondary markets for fund managers, with the ability to raise NAV financing.

Longer term investment horizons free investors from the limited liquidity requirements of some funds.

Clients select Bond structures: plain vanilla debt, asset backed finance, AMCs or shariah compliant certificates.

All Bonds have an ISIN and are listed on the Frankfurt Stock Exchange, allowing for direct purchase through the exchange, or other brokers.

Our structures open-up retail investment in private markets, directly or through fund managers.

Access to distribution platforms and our own affiliated platform.

For the investors in your capital raise.

Through tokenisation and the use of smart contracts.

Our bond structures and our trustee, advisory and administrative services smooth the flow of your capital raising transactions.

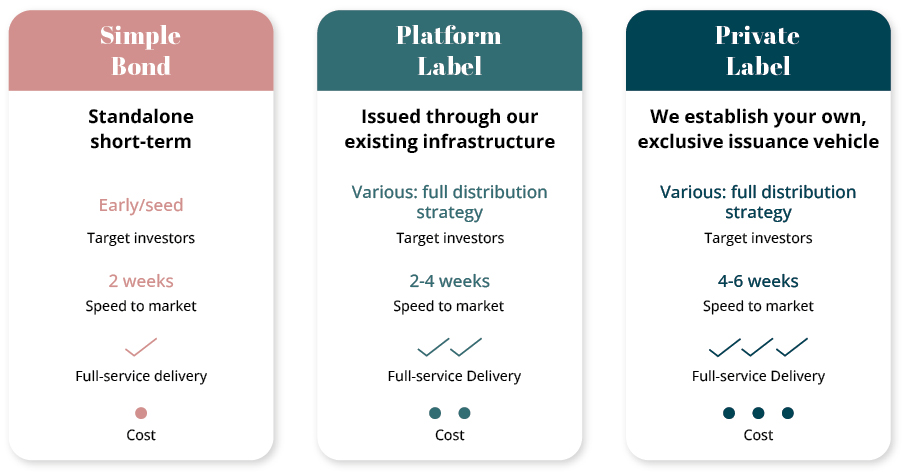

Simple bond: Ideal for early or seed investors, 2 weeks to market.

Platform label: Issued through our existing infrastructure, we offer plain vanilla debt, asset backed, AMCs and shariah compliant structures, 2-4 weeks to market.

Private label: Your own, exclusive issuance vehicle. We provide full-service delivery, 4-6 weeks to market, with a full distribution strategy.

CONTACT

+44 20 7961 9005

[email protected]

Truva Corp

3rd Floor, 30 Bedford Street

Covent Garden, London WC2E 9ED

If you would like access to view Truva’s client information, please email: